Protect Today – Invest in Tomorrow!

La Plata County is seeking a 1 cent sales tax increase.

The last time the County increased sales tax was in 1982.

The county's services are not glamorous but, they provide the basic foundations of our community.

Why a 1 cent Tax?

The county's core services delivered are not glamorous: they are the basic foundations of our community:

-

Connectivity – Roads, bridges, infrastructure

-

Safety – Law enforcement, wildfire response, emergency services

-

Land – Planning for growth, transportation

-

Health – Public and human services, sanitation

-

Economy – Support for job creation, tourism, agriculture

🛑 The County Government’s Budget has a Structural Problem

-

La Plata County is still operating on sales tax funding set in the 1980s; property taxes set in the 1990s and the long predicted decline in oil and gas revenue – is now here.

-

Meanwhile, the cost of roads, equipment, and public safety plus providing basic services to residents has skyrocketed.

-

In a growing community the demand for everything increases.

-

The Commissioners have cut the budget for two years and stretched every dollar.

-

La Plata County has the lowest sales tax rate of many like-counties.

-

We are simply out of options without new revenue.

📘What the Sales Tax Increase Will Support

-

Infrastructure – road maintenance and improvement, repairs and construction; essential County buildings and property upkeep

-

Public safety such as Sheriff patrols and emergency services and justice programs

-

Preparing for and responding to wildfires, floods and natural disasters

-

Essential services for vulnerable families, seniors and safety net programs

-

Assistance for Veterans

💵 What Would the 1% Sales Tax Increase Cost You?

This increase would bring in 18M a year. The average household in La Plata County invests a monthly increase of about $23 in sales tax. For the cost of eating breakfast out, the roads you drove to get there are cared for.

🧭 Why It’s Fair

-

Everyone contributes, not just property owners

-

The services the La Plata County provides are used by everyone

-

Tourists cover about 33% of all sales tax revenue; 100% stays in La Plata County

What Does The County Do?

How are my taxes spent?

You can have a breakdown of your personal taxes whipped up just for you!

Click on the link below and see what funds go where...

And, exactly how much is spent on your county services.

(No campaign funds were used to produce this tool. It is available to all County residents.)

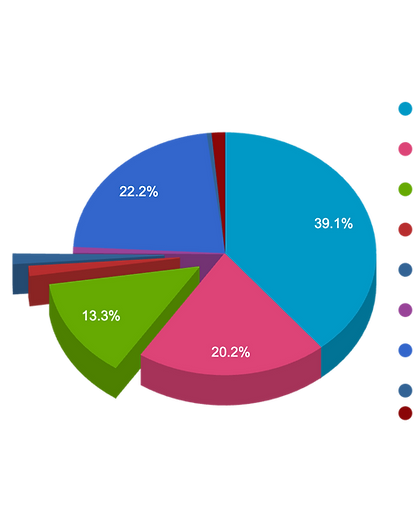

Example of a Tax Breakdown

Drango School District

Durango School Dist. - bond

LPC - General

LPC - Human Services

LPC - Road and Bridge

SW Water Conservation Dist.

Ft. Lewis Mesa Fire Protection

La Plata Water Conservancy

Montezuma Dolores County Metro Rec District

Example Breakdown

Myth vs. Fact:

Myth #1: “My property value went up, so the County must be rolling in money.”

Fact: Rising property values do not mean more revenue for La Plata County.

-

It’s a common misconception that rising property values result in the county increasing revenues.

-

The state has reduced residential assessment rates - this limits the amount the county receives in property tax revenue. (i.e., the county does not realize more money because your residential property taxes have gone up).

-

Want to know what you pay and where it goes? Try the county property tax calculator

-

Other special districts and some school districts have recently raised taxes but the County Government is operating services off of 1980s and 1990s revenue streams.

Bottom line: La Plata County is not seeing a windfall. Property tax revenue has remained flat in the midst of rising real estate prices.

Myth #2: “The County just needs to cut spending and balance the budget.”

Fact: La Plata County is legally required to balance its budget—and has done so.

-

The County is still working with funding streams set in the 1980s and 1990s.

-

We’ve already trimmed and stretched every dollar.

-

Without new revenue, the only remaining option is to cut core services, like Sheriff patrols, road and building repairs, and human services programs.

Myth #3: “A 1% sales tax sounds like a lot.”

Fact: The average household would pay about $23 a month— this is a tank of gas or a breakfast.

-

This modest amount helps maintain roads, emergency services, and public safety.

-

Every dollar stays local.

Myth #4: “Only residents will pay this new tax.”

Fact: Visitors and tourists contribute approximately 33% of La Plata County’s total sales tax revenue.

-

That means out-of-town visitors will help fund local services that everyone needs and relies on.

Myth #5: “This is just another government money grab.”

Fact: This is a community investment—and it’s fully transparent.

-

The funds will support essential services: roads, Sheriff response, infrastructure, and fire mitigation, snow removal, emergency response to fire, winter storms, and more!

-

The County is committed to clear reporting and accountability. All funds spent are audited.

Myth #6: “You ran the oil and gas industry out of the county so that is why you’re in a revenue pinch.”

Fact: For years, it was predicted that the Fruitland formation gas field would eventually decline. In fact, production is on the decline in San Juan County, New Mexico too.

-

The Commissioners passed updated oil and gas regulations in 2023. These regulations balanced production and property rights with public health and safety, and environmental protections.

-

The County has benefitted from oil and gas production taxes but starting in the early 2000s, it was always predicted that this revenue would decline, which it now has.

-

The County is committed to protection of people and the environment but also fully recognizes the role the oil and gas sector plays in the county.

-

The County budget can no longer primarily rely on the oil and gas sector to provide public service and pay the bulk of County Government costs.

Myth #7: If the County just fixed its planning department, it wouldn’t need this sales tax increase.

Fact: This is a distraction from the real issue.

Some opponents — especially developers — claim the County could solve its $18 million funding shortfall simply by approving more development or “streamlining” permitting. But here’s the truth:

-

Even with an efficient planning department, the math doesn’t add up. No amount of permitting reform could generate $18 million annually — not even close.

-

The proposed 1% sales tax supports essential services that benefit everyone: road maintenance, emergency response, public health, and support for our most vulnerable residents.

-

Delaying or denying this funding because of frustration with unrelated development rules puts those core services at risk — and punishes everyone in the county.

Let’s be clear: improving customer service and efficiency in the planning department is always a worthwhile goal. But using that as a reason to vote “no” on a much-needed, broad-based solution is short-sighted — and benefits only a narrow interest group at the expense of the greater community.

✅ The Truth:

We can’t maintain roads, staff deputies, or prepare for

wildfires using 1980s funding.

For about $23 a month, we can

Protect Today – Invest in Tomorrow!

Help Us Protect Today and Invest in Tomorrow

La Plata County is at a turning point.

Our roads, public safety services, and infrastructure are all operating on funding levels set in the 1980s and 1990s — despite decades of growth and rising demands on services. This November, voters will have a chance to fix that by supporting a modest 1% sales tax increase dedicated to preserving the quality of life we all value.

But we can’t do it without your help.

Your Donation Will Help Us:

-

Print yard signs and banners to raise local visibility

-

Purchase radio ads to reach voters across the county

-

Send informational mailers to households

-

Run social media campaigns to educate and energize

-

Cover printing and outreach materials for public events

Every dollar donated goes directly toward helping La Plata County residents understand what’s at stake — and why now is the time to act.

📢 Let’s make sure the community hears the truth — and has a chance to say YES to a stronger future.

👉 Contribute Today and help us Protect Today. Invest in Tomorrow. Vote Yes on 1A.